Further to our earlier update on 22 April 2024, the Treasury has now released its Consultation Paper on Merger Notification Thresholds in Australia. The paper discusses proposed changes to Australia’s current approach to review of merger transactions, which are intended to take effect from 1 January 2026.

Key to the Treasury’s proposed changes is the creation of a legal obligation to notify acquisitions that are captured by notification thresholds, coupled with a substantial penalty for a failure to notify. The Consultation Paper describes the following objectives for the proposed thresholds:

- Capturing anti-competitive and economically significant acquisitions, including serial acquisitions;

- Scrutiny of acquisitions by acquirers with substantial market power, including of nascent competitors; and

- Targeting acquisitions that directly affect Australian consumers.

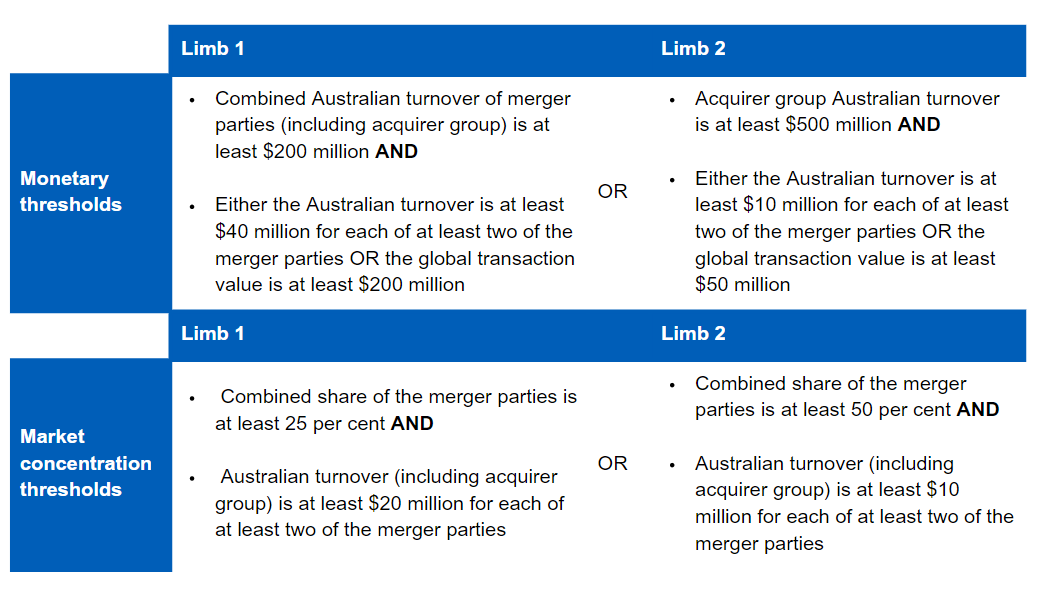

The proposed monetary thresholds mean that an acquisition must be notified to the ACCC if at least one of the following monetary or market concentration thresholds limbs are met, and there is a material connection to Australia:

Acquisitions undertaken within the previous three years by an acquirer/acquirer corporate group within the same product/service market are also proposed to be aggregated for the purposes of assessing whether a threshold is met.

Other important takeaways from the Consultation Paper include:

1. Ministerial Power

Where competition risks change or arise over time, a Treasury Minister may set targeted notification requirements to ensure that potentially anti-competitive transactions are examined by the ACCC. The ACCC considers that groceries, fuel, liquor and oncology-radiology are sectors in which competition issues could arise. An example of this identified by the Select Committee on Supermarket Prices is the use of land-banking and creeping acquisitions by participants in the grocery retailing sector.

2. Consequences for non compliance

Where an acquisition meets one of the thresholds above, notification to the ACCC will be compulsory and if the merger parties fail to notify the ACCC, substantial penalties may be applied and the unnotified transaction will be legally void.

3. Timeframes for review

Mergers will be able to proceed within 30 working days of notification, unless the merger raises competition concerns. The ACCC will also provide a fast-track determination process if no concerns are identified within 15 working days of notification.

4. Voluntary notification and waiver

Businesses conducting transactions below the notification thresholds will be able to submit a voluntary notification of such transaction in order to obtain certainty. The Consultation Paper also notes that the Government is considering a notification waiver option where there is uncertainty surrounding the application of the thresholds to a particular transaction. Such a waiver would:

- relieve a party from the requirement to notify an acquisition

- prevent the ACCC from later bringing failure to notify proceedings against the acquirer, and

- exclude the transaction from any potential penalties associated with failure to notify (including voiding).

Submissions may be made in respect of the Consultation Paper until 20 September 2024. The Consultation Paper is available here.

We are here to help

If you would like to discuss the proposed changes to Australia’s merger laws or how they may affect a transaction, please contact our Mergers and Acquisitions team.