The Victorian Government has announced significant reforms to commercial property taxes. Stamp duty will be progressively abolished and replaced with a new annual “commercial and industrial property tax” (CIPT). The new tax scheme will apply to commercial and industrial properties in Victoria. The Commercial and Industrial Property Tax Reform Act 2024 (Proposed Act) has now been passed and is expected to apply to transactions from 1 July 2024.

Here's what you need to know:

- All commercial and industrial properties that are transacted after 1 July 2024 will be subject to the new CIPT scheme from the settlement date.

- These transactions will attract one last stamp duty payment by the purchaser. Purchasers may be eligible for a loan from the Victorian Government as an alternative to making an upfront payment of stamp duty. The loan amount, plus applicable interest, is to be paid off annually over 10 years.

- Irrespective of whether duty is paid or a Government loan is utilised, the annual CIPT will commence 10 years after the settlement date, whether or not there are further transactions of the property in that time.

- The annual CIPT will be calculated at one per cent of the property’s unimproved land value with no tax-free threshold.However, exemptions and concessions will be applicable on some properties.

Given that the CIPT system will result in various tax implications for both vendors and purchasers of commercial property it is crucial for you to understand how this will affect your business.

How does this affect you?

Whether you are buying or selling commercial or industrial property, you should be aware that the property will be subject to the CIPT scheme for transactions occurring after 1 July 2024. Under the Proposed Act, dutiable transactions that occur pursuant to an arrangement or an agreement before the commencement of the Proposed Act will not be subject to CIPT. While these terms are not defined, the Commissioner of State Revenue has previously accepted arrangement can have a broad meaning. Terms sheets, options, and rights of refusal are examples of potential arrangements as well as contracts of sale entered into before 1 July 2024.

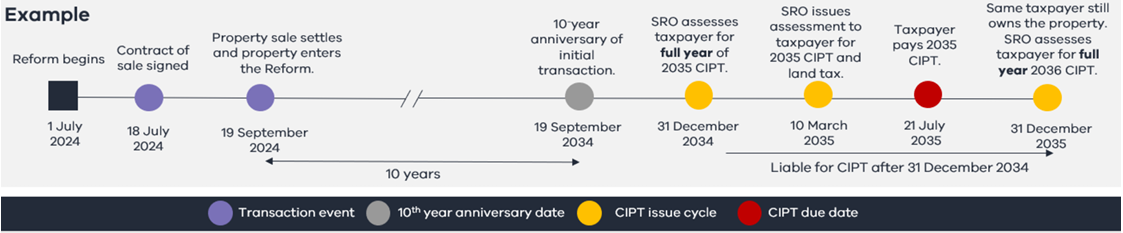

Example

A vendor and purchaser enter into a contract of sale for a commercial property on 18 July 2024 and complete settlement on 19 September 2024. The property enters the CIPT scheme on 19 September 2024.

The purchaser pays the last ever stamp duty payment on 19 September 2024. The purchaser, if eligible, may take a loan from the Government for the duty amount instead of paying the duty at settlement. The purchaser will make 10 annual repayments of the loan plus interest.

The 10 year anniversary of the property entering the CIPT scheme is 19 September 2034. The SRO will assess the owner of the property as at 31 December 2034 and the first annual CIPT payment will be payable in 2035. This is regardless of any further sales of the property in this time.

The purchaser decides to sell the property to a new purchaser. Settlement is completed on 2 February 2028. The new purchaser is not required to pay any stamp duty. The new purchaser will start paying the CIPT in 2035, as this is 10 years after the first settlement of the property under the CIPT scheme.

If the first purchaser took a Government loan for payment of the stamp duty, the first purchaser must pay the balance of the loan amount and break costs to the Government at the second settlement.

Image source: Department of Treasury and Finance Victoria, Commercial and Industrial Property Tax Reform

Types of properties affected

A property with a commercial or industrial use will be within the CIPT scheme if the property:

- is allocated an Australian Valuation Property Classification Code (AVPCC) by the Valuer General that is in the ranges of 200-299 (commercial), 300-399 (industrial), 400-499 (extractive industries) or 600-699 (infrastructure and utilities); or

- is land that is used solely or predominantly for eligible student accommodation.

It is expected that the AVPCC will be noted on future land valuations.

The sale of all other properties, for example residential, will continue to attract duty.

Recovery of CIPT by vendors

The Proposed Act prohibits adjustments on account of CIPT on the sale of property. It is also proposed that section 32 statements must disclose a statement as to whether or not the land has entered the CIPT scheme and if so, the date of entry and the AVPCC most recently allocated on the land.

How are leases affected?

A landlord may be able to negotiate to recover CIPT from tenants as an outgoing. However, it is proposed that recovery under a ‘retail premises lease’ will be prohibited by amendments to the Retail Leases Act 2003 (Vic).

Change of use, subdivisions, consolidations, part property sales, etc

The Proposed Act also provides how duty is to be calculated on a change of use of a property, as well as where properties are subdivided and consolidated and also where only part of the property is used for commercial and industrial uses. Properties may be brought into the CIPT scheme by entry subdivisions or changes of use, which may have nothing to do with buying or selling the property.You should be particularly careful not to inadvertently cause an entry into the CIPT scheme (and commence the 10 year countdown to the annual CIPT) simply by consolidating or subdividing, which might be entirely unrelated to a sale or purchase, but could cause as larger future tax impost.

These changes are significant and may affect more than 265,000 (https://www.dtf.vic.gov.au/funds-programs-and-policies/commercial-and-industrial-property-tax-reform) properties within Victoria. We want to ensure you have the opportunity to make informed decisions regarding your property transactions.

We are here to help

If you are considering buying or selling commercial or industrial property, or possibly have any properties you suspect may be caught by these potential changes, get in touch with Mark McKinley, Samantha Taylor or Caroline Snaidr.

Keep up to date with Russell Kennedy alerts, insights and upcoming events by subscribing to our mailing list here.