Introduction

The recent succession battle within the Murdoch family over the control of the world’s most powerful media empire serves as a fascinating case study in estate planning.

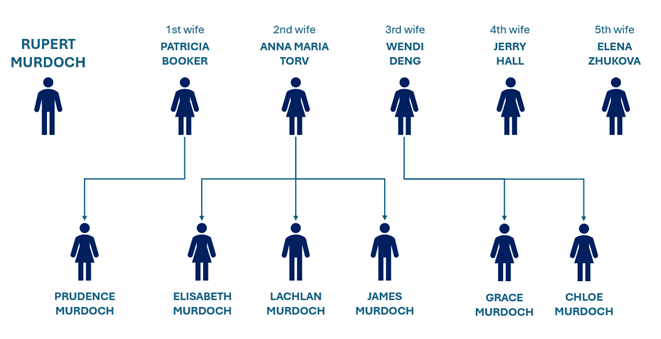

Australian-born American media mogul, Rupert Murdoch, 93, tried and failed to amend his family trust to grant his son, Lachlan, complete control over News Corp and Fox Corporation upon his death. It is reported that the family’s control extends to a combined market capitalisation of approximately US$40 billion, encompassing investments in a number of assets such as Fox News, Fox Business, the Wall Street Journal, the New York Post, the Australian, the Sun and the Times.

When a person dies, the Legal Personal Representative's (LPR) role is to carry out the terms of the Will or the intestacy scheme (if there is a no will) and to administer the estate of the deceased.

Background

In 1999, Rupert created an irrevocable family trust in the US with a total of eight votes. Four of these votes are controlled by Rupert himself, while the four remaining votes are each controlled by four of his children, Prudence, Elisabeth, Lachlan and James. His two youngest children, Grace and Chloe, have no voting rights in the trust. According to the trust’s terms, Rupert’s four votes will be equally distributed among the four current vote-holders on his death.

The family battle started in 2023 when Rupert attempted to completely alter the vote distribution of the trust, and took Prudence, Elisabeth and James to court. Rupert’s goal was to give Lachlan sole control of the trust at the expense of the three other voting rights beneficiaries. It was reported that Rupert took this step to ensure his media empire remained conservative and because Lachlan’s political views closely aligned with his own, while his other children are more politically liberal.

Court Decision

Rupert chose to file his application to vary the trust in Nevada, US, where there is a high degree of privacy over such proceedings of a private legal nature, which prevented publication of details that would typically be required in other jurisdictions like Australia.

Before the trial began, the Nevada probate court stated that Rupert could amend the irrevocable trust if he could prove that he is acting in good faith and for the benefit of his heirs. However, at the conclusion of the trial on 9 December 2024, probate commissioner Edmund Gorman Jr. delivered a 96-page ruling against Rupert and Lachlan. The father and son were held to have acted in “bad faith” in trying to change the irrevocable trust. The attempt was described as a “carefully crafted charade” to “permanently cement Lachlan Murdoch’s executive roles” in the empire with no regard to the impact such control would have on the companies or other beneficiaries of the family trust.

Lessons Learnt

- The Murdoch family feud emphasises the significance of estate and business succession planning, especially in blended families. It is important to consider who will hold the control position and who will be named as beneficiaries in your estate planning documents, as imbalances can lead to disputes that may ruin family relationships. We can assist you in creating a tailored estate plan that offers peace of mind by ensuring smooth transitions and mitigating potential conflicts, such as family provision claims.

- The Murdoch family’s trust highlights the importance in setting up trusts that reflect your intentions and the length and breadth of any powers of amendment. We can help you in establishing trusts or reviewing existing trust structures based on your family dynamics. It is crucial to review and possibly update your trust deeds and estate planning documents where there are significant life events to you or the people named, such as marriage, divorce, birth of children, death or sickness of a named person, or significant changes in wealth or disposal of assets.

- Although the Murdoch family's dispute centres around their ultra-high-net-worth businesses, succession challenges can arise in family businesses of any size. Therefore, when setting up a family trust or planning for the succession of your wealth and/or businesses, it is important to anticipate that your family circumstances and your wishes may change over time. If you are a business owner, you should plan early on how to structure your estate and its succession to ensure your wishes are followed through after passing.

How we can help

Contact Ilana Kacev, Principal, Taryn Ellerington, Special Counsel, or members of our expert Wills and Estates Planning Team who are happy to help you get started on your estate plan or updating your current estate plan.

If you would like to stay up to date with Alerts, news and Insights from our team, you can subscribe to our mailing list here.